Event Recap: The Alliance 2021 Spring Symposium

This is a blog recap of our virtual event, The Alliance 2021 Spring Symposium, held on May 6. Click here to view the recording and for more Employer Resources.

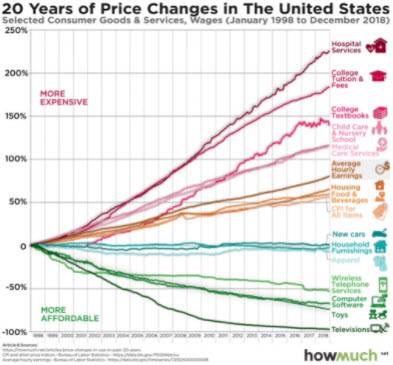

Cheryl DeMars, CEO of The Alliance, kicked off the event by illustrating how the rate of medical inflation is outpacing all other inflation. The graphic she referred to shows that medical expenses have increased by 225% over the past 20 years while wages only increased 75% during that same span.

“Health care is eroding our ability to pay for other things that contribute to the health and wellbeing of our families,” she concluded.

This was meant to set the stage for the rest of the day and Cheryl then introduced Dr. Marty Makary, the keynote speaker. He jumped into his presentation by explaining how he’s optimistic about the future of health care – especially for employers.

“I’m a big fan of The Alliance. You’ve done a terrific job,” he began. “The patient is fed up with the current system, and nobody really advocates for the consumer except for employers. We’re the voice for the voiceless. There is a profound enthusiasm to redesign a better health care system and its being driven by employers. Keep up the advocacy, it’s important and we need it.”

Further, he explained that 88% of Americans agree on wanting transparent prices. “Health care transparency is bipartisan. We got the transparency rule and now we’re working on compliance,” he said, referring to the Hospital Price Transparency rule.

The Voice for The Vulnerable

Dr. Makary briefly recapped the history of modern medicine and how the medical field has long stood up for the vulnerable by explaining how America’s first hospital, Pennsylvania hospital, had a mission to take care of anybody – regardless of race, citizenship, or their ability to pay.

“We’re in a very different position today,” he continued. “We spend $16 billion on measuring outcomes. We’ve got a cost crisis that’s spinning out of control.”

An Appropriateness of Care Crisis

Dr. Makary suggested that the health of a population is one of the highest costs. “The United States is the most obese, most overly medicated population in the world. Ten years ago, we prescribed 2.4 billion medications. Last year, we prescribed 5 billion. Disease hasn’t doubled – we have a crisis of appropriateness. Appropriateness is the leading issue in health care that we’re not talking about, but that we need to be talking about.”

Currently, we measure health care quality in terms of the outcome only, said Dr. Makary. For example, 75% of patients with appendicitis could be successfully managed with antibiotics alone. “That’s earth-shattering in an area where everyone is trained to treat it with an appendectomy. Not only does it reduce the number of opioids prescribed, it has implications for cost, hospital utilization, and the waitlist schedule.” And it all adds up to an overworked, wasteful, and inefficient health care system.

The Direct Primary Care Solution

Dr. Makary explained how the appropriateness problem could be solved: by addressing underlying issues rather than reacting to symptoms. “We’re consistently looking at drugs rather than underlying causes, and what we’re discovering, in terms of primary care, is that those who spend more time with their patients address those underlying causes and have better outcomes.”

Direct Primary Care, for example, forgoes the traditional fee-for-service payment model, often using a monthly fee for unlimited access, to produce closer primary care relationships that better benefit patients. In his words, “when you get people off the fee-for-service treadmill, amazing things can happen.”

He then ran through examples of how physicians administer appropriate care after spending more time with their patients:

- High blood pressure addressed by monitoring sleep and stress levels rather than just prescribing hypertension medications.

- Diabetes treated with cooking classes rather than simply prescribing insulin for the rest of their lives

- Back pain treated with ice and physical therapy rather than surgery and opioids.

The Price We Pay

Next, Dr. Makary moved on to the topic of cost. He put it simply: people don’t understand how much money is going into health care. And it’s a lot.

“We’re all paying in different ways because health care has many hidden costs.” He said while pointing out a pie chart displaying the US federal spending makeup, which showed that 25% of our federal budget goes towards Medicare and Medicaid. However, suppose you take into account the amount of money that social security uses towards medical care, the amount the Department of Defense (DoD) uses on their health care system, the amount Veteran’s Affairs (VA) spends, the interest on the health care spending debt, and what we pay for federal workers’ health care benefits, the actual amount of federal spending on health care is actually closer to 48%.

He bolstered his statement by explaining how the average family spends roughly $20,000 per year on medical expenses, which does not include what employers are paying for them.

“And after all that spending, folks are told that their care isn’t covered,” he said. “People have a right to be angry.”

The Future of Price Transparency

Dr. Makary then explained that improved transparency produces lower costs for employers and consumers. “The reason price-gouging happens is because you are never given a price – even for ‘shoppable’ procedures.”

He then compared hospital pricing to airline pricing. “Imagine you’re buying a plane ticket, and the airline says ‘we can’t give you a price because we don’t know what the flight will cost us. We don’t know if there’s going to be a delay, cancellation, or if the pilot will experience turbulence.’ And then, after the flight, you’re billed separately by the pilot, the airline, the stewardess, and Coca-Cola for the marked-up soda you had on the plane. We can do better.”

Next, he provided a story about a researcher who called 100 different hospitals requesting a cash price for a standard procedure. “Only half of the hospitals gave him a price after haggling, calling back, and sometimes escalating the issue to the CFO. The hospitals that provided prices ranged from $44,000 to $500,000 for the same procedure.”

Further, the highest cost estimates did not belong to the highest-quality hospitals. “[This procedure] has the most mature quality registry in all of health care,” Dr. Makary explained. “They have all their outcomes independently assessed by a nurse reviewer and then submitted to the Professional Society of Thoracic Surgeons.” In other words, there was no association between quality and price. Dr. Makary’s team also found no association between the cost estimates and the amount of charity care each hospital produced.

Good People in a Bad System

“We have a great medical heritage and need to maintain our public trust,” said Dr. Makary. “Price-gouging and predatory billing is threatening that trust.” He supplemented his statement by referencing a 2019 JAMA study that discovered a single community hospital in Virginia (in a town of 30,000 people) had sued its patients over 25,000 times. The most common employer for those patients? Walmart. That means, in Dr. Makary’s words, “they’re not deadbeats… These are people living paycheck to paycheck.”

He concluded his statements about price by saying he doesn’t believe any “diabolical” individuals are to blame.

“There aren’t bad people in health care. These are good people working in a bad system… the system is broken… As we continue to blame, we continue to make mistakes.”

Employer Guidance

So what can employers do? According to Dr. Makary, “we need more boldness when it comes to creative benefit plan design. There’s a reluctance to innovating health benefits because there’s a misconception people are getting a good deal.” On the contrary, he pointed to RAND Corporation’s findings that commercial plans pay 247% more than Medicare, on average.

“Employers are the most exciting area in all of health care,” stated Dr. Makary. “Talk to multiple benefit designers and strategists instead of just one, then find and talk to people who have used that PBM or health plan, etc. Then get creative with new relationship-based products. There’s a lot of great innovation out there.”

Content Expert Question-and-Answer Session

And to talk about that opportunity for innovation, a panel of data consultants were asked to answer top employer questions. This session was moderated by Melina Kambitsi, Ph.D., SVP of Business Development and Strategic Marketing at The Alliance. An abridged version of the following content experts’ answers is below.

- Gerald Frye – CEO, The Benefits Services Group . External Link. Opens in new window.

- Sarah Delaney – Vice President, Analytics Services, Marsh & McLennan

- Sara Hames – Consultant, NBS Advisors, LLC

Melina: We know health care is expensive, so based on your work, can you describe strategies to make health care more affordable for their self-funded plan and its employees?

Jerry Frye: For employers to reduce the cost and improve quality, they need to understand the appropriateness of care. On a macro basis, only 17% of the total cost of care is influenced by prices. The other 83% is appropriateness, efficiency, quality, etc. So it’s important to have ways to measure those.

But most of the reporting you get from the major carriers isn’t showing the continuum of care. When you actually look at the efficiency of individual providers, the pharmacies are calling the doctor’s office to get an insulin refill. 67% of the excess insulin being delivered is due to a lack of primary care relationship with the patient.

Episodes of care also allow you to benchmark considerably differently. We can’t just beat the other guy by a little bit. The system is broke, so you need to start benchmarking. You take these episodes, grade them on how well they were performed, and assess them. 40-60% of these episodes are terribly inefficient. In a $20 million spend, you’ll find that $8 million of it is inefficient. We can’t afford average – you have to get the best care price.

Sarah Delaney: Bringing in a clinical expertise. We’re looking at claims data to identify inappropriate utilization. We’re tying together all the pieces of data together and focusing small. It’s one piece. You don’t have to find the right answer; you have to focus on where the data is actually driving things.

Sara Hames: If you’re not working with a transparent partner like The Alliance there’s a definite lack of actionable data. What’s the member spend? Our average workforce cannot afford it anymore. Employers need to recognize their employees are not getting the care they need because they can’t afford it. Afraid of surprise medical billing? One of the solutions is finding that strong primary care relationship and making it very affordable to your membership. Find that provider who will take the time with patients, treat them, and keep them from being transferred to a system they will be lost in – and get flooded with bills. People need to go to get the care they need without worrying about affordability.

Melina: How do your employers encourage your employees to make better health care decisions?

Sara Hames: The best way to do that is to create those choices for them. Tell them what’s a smart choice. The member cannot navigate the landscape on their own. The tools out there are inaccurate and complicated. Tell them where they can go and incent them to go – make it free or low-cost, which will be even more impactful.

Melina: Can you ever be looking at too much data?

Jerry Frye: There’s no end to the amount of data available. What employers need is actual intelligence which is data put into the proper context within the strategic plan of what the employer is trying to accomplish. A 70-page report isn’t going to help without actual synthesis. Give employers the two, three, or four nuggets that they should focus on.

Sarah Delaney: You can sometimes get information paralysis. You just have so much information you don’t know where to start. That’s where employers struggle. They go through a 30-page report in two hours that’s boring demographic information. Our job is to take data and make it information. What are the five bullet-points? What do I need to change and how can I change it?

Melina: How are you addressing the cost challenges of non-compliant patients?

Sara Hames: Primary care. Having that dedicated primary care agent is huge. Having direct contracts for bundled payments, and a 2nd aspect that focuses on patient compliance as the patient goes through the journey, they’re incentivized for following through on what they’re supposed to do. One such organization had 98% compliance which is amazing. If you coach patients along and help them do what they’re supposed to do, it’s much more likely to happen.

Sarah Delaney: We have a case study of a 500-employee group that were was doing biometric screenings, and they stopped offering them when they noticed primary care visits decreased. So they dropped them and instead are incentivizing primary care visits. As a result, they’ve seen a 25% increase in primary care visits, 10% decrease in ER utilization, and cancer screenings are now 10-15% better than benchmark.

Jerry Frye: This starts with primary care. Then you need to have the right network for referrals. Then you need some form of coaching, advocacy, navigation, etc. to help the employee. There has to be some connection to the health provider to act as a resource for the consumer. Poor adherence is often due to ignorance, and this would help with that.

Melina: What are the pros and cons of primary care relationships in states where most hospital systems are extremely consolidated?

Jerry Frye: Wisconsin has more integrated care systems than any other state. We also have the highest concentration of provider-owned health plans. This is a common problem in Wisconsin. The primary care needs to be held accountable to best-practices because the health system is going to try to steer all their care internally. It’s very difficult to do Direct Primary Care in Wisconsin. You have to work with someone like Sara Hames, Sarah Delaney, or us to get there – because the health systems make it very difficult to get there.

Sara Hames: Direct Primary Care is coming back; 80% of doctors working in health care systems are not happy doctors because they don’t get to spend the time with their patients. They become revenue generators which goes against their education, and they just want to get back to treating patients. The independent relationship gives people a different perspective. Direct Primary Care is coming back – The Alliance is focused on that. Most of my clients have their own employer-sponsored clinics. If you spend time on it and do it right, they can be amazingly successful. Better outcomes, lowered costs, and higher patient appreciation, talent acquisition, and employee retention.

Sarah Delaney: The reality is that this is a systemic problem. Pushing for quality of care and data is the only way to change their payment methodology. It’s a slow burn, unfortunately. At the end of the day, fee-for-service has to go away at the physician level.

Melina: The size of the average employer at The Alliance is between 170-200 employees. How do small employers get their data?

Sara Hames: The size doesn’t matter, the partners do. You’ve got to look at health care differently. Say you’re The Alliance and have 50 employees on your self-funded plan; if you steer to the right providers you can improve things. Be bold. Think differently. What are the problems? What can we do to solve them? Push your broker to push the insurer to get your data.

Melina: Yes, The Alliance currently has 40 employers using QualityPath and 60-70 actively steering their employees using The Premier Network. Do you have any final thoughts?

Sara Hames: But that’s important! It takes a lot of work to get all those contracts, so thanks to The Alliance for doing that because it’s good for everybody.

Jerry Frye: Regardless of size and access to data, get the primary care relationship set. Then get your employees information on where to be referred to. Then coach them or navigate them. If that person is informed with the right information, they’re likely to make the right choice. By the way, that’s what The Alliance does best!

Sarah Delaney: The important thing is holding your vendors, partners, and employees accountable. Get the right partners and get the data you need. Help steer your employees in the right direction but giving them the tools and education to help them make the right decisions.

RAND Corporation’s Hospital Price Transparency Project

Cheryl closed out the event by urging employers to participate in RAND Corporation’s ongoing health care price study, which acts as an independent, objective data resource for employers and enables them to:

- Be better-informed shoppers of health plans and health care

- Hold hospitals, health systems, and health plans accountable for the prices they have negotiated

- Report hospital prices relative to a Medicare benchmark

RAND uses claims data from multiple resources, including self-funded employers, to create a public hospital price report that’s freely downloadable. They name facilities and systems and their inpatient and outpatient hospital prices.

“The Alliance is digging into the information we received from RAND’s 3rd round to control prices while ensuring quality of care. We’re only beginning this work,” said Cheryl.

To participate and obtain your private report – which shows the actual allowed amount you paid, the relative price paid by other organizations in your area, and more – please email Brian Briscombe (bbriscom@rand.org. External Link. Opens in new window.) and confirm your insurance carrier (or data warehouse) by May 28.