New Transparency Trends: 3 Healthcare Problems (And Their Solutions)

There’s growing price transparency concerns among employers whose health care costs – which amounted to $1.2 trillion in 2018 – continue to outpace wages and inflation. More than half of those costs can be attributed to hospitals and physicians.

Hospitals account for 31% of health care costs, while physicians account for 20%. (The next highest U.S. expenditure is prescription drugs at 8%.)

Gloria Sachdev, President and CEO of the Employers’ Forum of Indiana, joined us at The Alliance Spring Symposium to discuss how employers can promote better value from hospitals. Keep reading to learn how these costs are trending and what Sachdev believes employers can do to curb them.

Price Transparency Problems Trending in Health Care

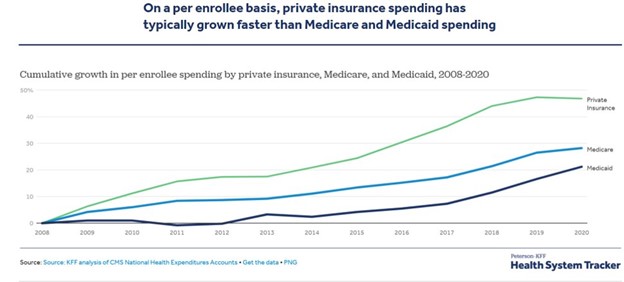

Private Insurance Spending Has Grown Faster Than Medicare and Medicaid Spending

From 2008 to 2020, private insurance spending grew faster on a patient-level basis than Medicare and Medicaid, and that gap is growing. This trend in price is perhaps why states like Wisconsin are paying 307% more than Medicare for the same services.

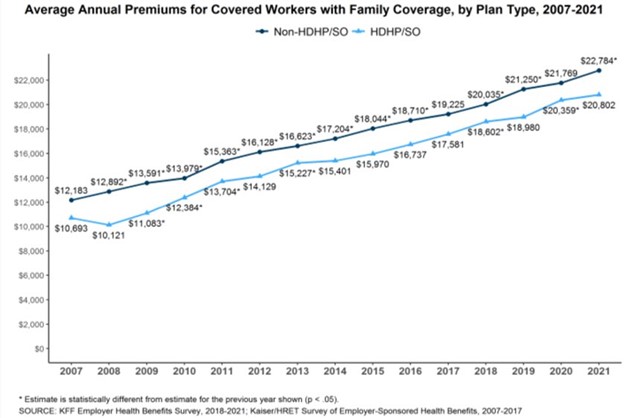

Patients are Paying Increasingly More Out-of-Pocket

While the affordability of health care decreases for employers, they are forced to shift costs onto their employees in the form of higher premiums, deductibles, and co-pays. This increased cost-share prevents employees and their families from utilizing health care because they’re afraid of incurring a high bill.

Unfortunately, employees are historically not great shoppers when it comes to seeking High-Value Health Care, and employers should use this data to design cost-effective health benefit plans.

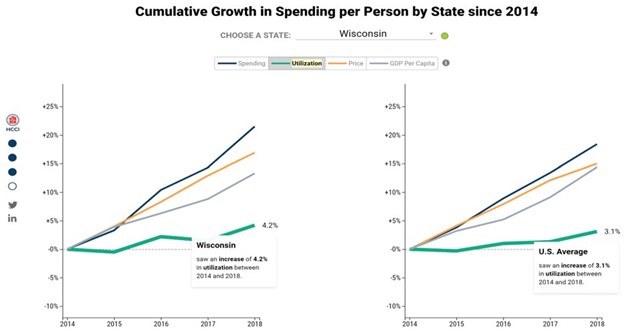

Prices Are Rising Much Faster Than Patient Utilization

Per the Health Care Cost Institute (HCCI), utilization grew 4.2% in Wisconsin from 2014 to 2018, while health care prices rose nearly 25% in that same timespan.

This trend aligns with U.S. averages and is unsustainable for employers. How many can afford another 25% price increase over the next five years?

The Solutions

Create a Functional Market

The health care market is broken; a functional market is based on choice. Employers and people can’t make choices if they don’t have price and quality information to shop for high-value care. Employers need to strive for 100% transparency or consider alternatives, such as payment regulations or consider a public option.

We encourage employers to use data from sources like RAND 4.0, NASHP’s Hospital Value Tool, and Sage Transparency – which aggregates data from both and others – to ask their brokers where their health care spending falls compared to regional averages and what they can do to improve.

New Legislation

Policymakers and employers must use transparency of information to make evidence-based decisions, but as we’ve seen in states like Indiana, transparency alone will not reduce prices. Health policy is necessary to buck the trend of rising costs while creating guide rails to prevent unnecessary price increases.

The Alliance’s Health Policy Committee is just one way our employers have been getting involved at the legislative level. Here’s some policy issues that, together, we’ve worked on with our employer-members. If you’re interested in learning more about public policy, consider signing up for our Health Policy Insights newsletter!

The Provider Solution

Many hospitals, physician groups, and independent doctors have become part of the health price solution. Employers need to seek out these innovative providers and partner with them to create alternative payment methods and place pressure on the status quo to create more competition and affordable health care prices.

Employer Innovations

Employers don’t just play an essential role in improving health care value, but a vital one. Employers need to take an active role in negotiating and monitoring health care prices while holding themselves accountable when it comes to utilization and waste.

Additionally, employers should actively advocate for system improvements and seek innovative partners – unaffiliated with the provider – that use evidence-based cost-containment and quality strategies.

To learn more about self insured health plans, check out our Smarter Self-Funded Health Plans page.